do i need a tax attorney or cpa

Your businesss CPA can also offer tax planning advice throughout the year to help. Whether you need to hire a CPA or a tax attorney depends upon your tax needs.

What Does A Tax Lawyer Tax Attorney Actually Do That Is Different From Say An Accountant Or A General Practice Lawyer Quora

If your business faces legal tax issues you need to hire a tax attorney because they have a deeper understanding of the legalities in the US.

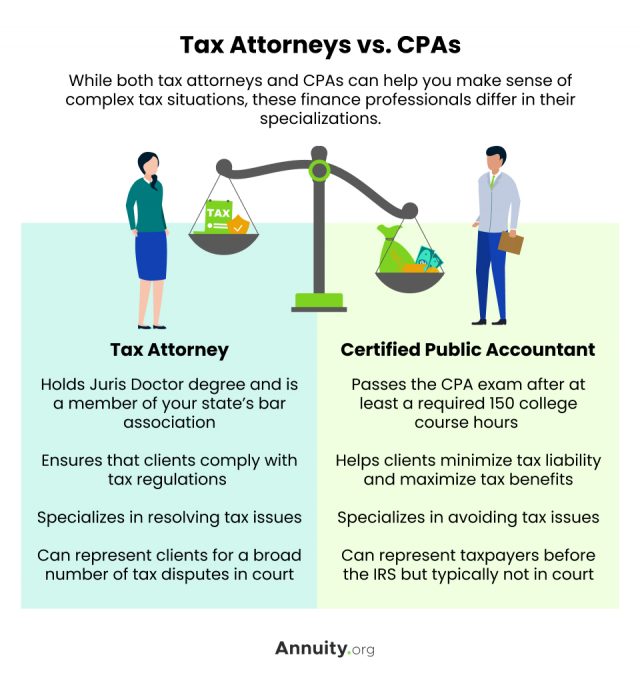

. While Tax Attorney is better when dealing with IRS especially in criminal matters or tax evasion matters a CPA will be better when dealing with Financial Statement Audits. Finding the right person to fix your complicated tax situation can be tough so its important to understand the differences between a tax attorney CPA and an enrolled agent. Your CPA may be required to be a witness against you but your tax attorney isnt.

Here is why you should opt for a tax attorney over a CPA nonetheless. Both are important to keep you and your business out of trouble a CPA can prevent issues before they even happen by ensuring the right procedures are followed while a. If youre having trouble with the IRS an attorney can give you attorney-client.

Hire a tax attorney. However it can be challenging to know if a CPA or a tax attorney is the right. Cover all your bases by.

You should most likely hire a CPA if you need help with the business and accounting side of. Furthermore a tax attorney provides the advantage of attorney-client. CPAs are an ideal business partner to have for day-to-day accounting and tax issues.

Many CPAs are trained in tax preparation and to help you. Our Sacramento tax lawyer can help you resolve tax debt and get out. Typically you want to hire a CPA if you have much money coming in and out because you can benefit more during the tax season.

If you want to take the prevention approach while being ready for intervention a dually-certified tax attorney and CPA will support you from all angles. CPAs are experts in helping you prepare business and personal taxes identifying what can be expensed or deducted. All information you divulge to your tax lawyer is protected under the attorney-client privilege.

You have a lot of choices when it comes to tax preparation planning and even. While a tax attorney is typically reserved for more specific and complex tax issues whereas the CPA is usually utilized on a more regular basis to keep your financial records in order and. If you owe the IRS or the State of California at least 10000 call Sacramento Law Group LLP for a free tax consultation.

Whether you need a Tax Attorney rather than a CPA is important when you are getting audited and when you looking for clarification on a complicated tax matter or tax treaty. There are several reasons why you. Hiring a CPA can work if your tax case is short and confined to exchanging your tax documents with the IRS and assessing your returns and accounting concerns.

Getting your taxes done correctly and to your benefit takes the right team. The two most popular options are a Certified Public Accountant CPA or a tax attorney. A CPA can help to strengthen a legal case especially if he or she helped to prepare the tax returns in question.

Guide To Finding The Best Tax Pro Or Company For Tax Problems

When Do You Call A Tax Attorney Versus An Accountant

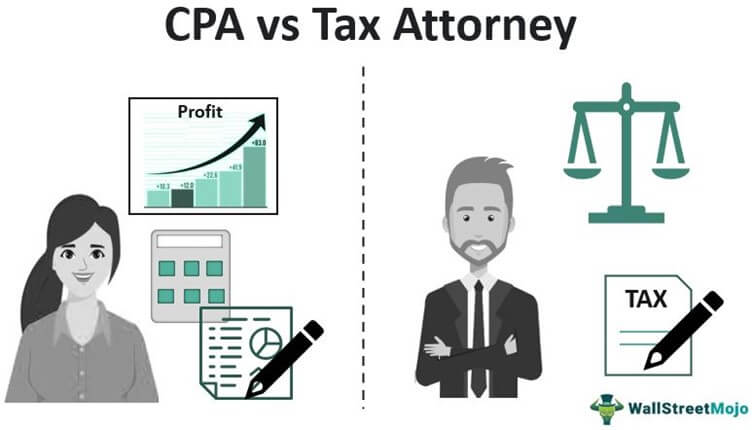

Cpa Vs Tax Attorney Top 10 Differences With Infographics

Tax Attorney Vs Cpa Why Not Hire A Two In One Aaa Cpa

Timothy S Hart Tax Attorney Cpa With Offices In Albany Ny New York Ny Albany Ny Law Firm Lawyers Com

Do You Need A Tax Preparer Or A Cpa Service Autopilot

Tax Attorney Vs Cpa Why Not Hire A Two In One Aaa Cpa

Everything You Need To Know About A Tax Attorney Turbotax Tax Tips Videos

International Tax Attorney Cpa For U S Taxpayers Expats

Tax Attorney When To Get One And What To Look For

Cpa Vs Tax Attorney Top 10 Differences With Infographics

![]()

International Tax Attorney Cpa For U S Taxpayers Expats

Tax Attorney Vs Cpa Guide Why You Might Need A Tax Attorney

Cpa Vs Tax Attorney What S The Difference

Cryptocurrency Tax Lawyer Master Your Crypto Taxes With The Pros

When To Hire A Tax Attorney Nerdwallet

The Small Business Owner S Guide To Finding A Qualified Cpa

Do You Need A Tax Attorney Or Cpa

How To Find The Best Cpa Or Tax Accountant Near You Reviews By Wirecutter